Piercing the Corporate Veil Basics

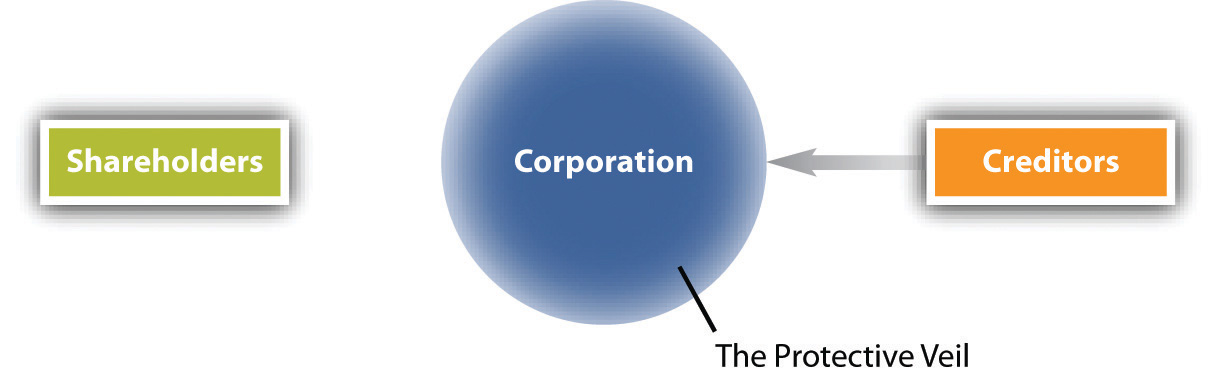

As many of you probably already know, one of the advantages of running a business as a corporation is the ability to limit the liability of its shareholders (owners). Generally speaking, shareholders are only liable for the amount of money they put into the corporation (in other words, their investment). For example, if you own a stock of a publicly traded company, you are a part owner of that company. If the company goes out of business, goes bankrupt, or has to pay a large legal settlement, you will only lose the money spent to buy that stock. However, in some situations, courts will force the shareholders to be liable for more than just their investment in the company. This is called “lifting” or “piercing the corporate veil.”

Courts are generally hesitant to pierce the corporate veil, but will often do so when the corporation acted in an illegal manner and holding only the corporation liable would be unfair to the victim(s). For example, let’s say an individual sets up a corporation for the business of operating taxi cabs. The individual is the sole shareholder of the company. The corporation knowingly hires unqualified individuals to drive the cabs and deliberately refuses to purchase liability insurance to pay for injuries to passengers or pedestrians in the event that a taxi cab is in an accident. Besides the cabs themselves, the corporation has very few assets. One day a taxi cab plows into a crowd of pedestrians, killing 20 people. Later it is revealed that at the time of the accident, the driver of the cab was drunk on alcohol and high on drugs. It’s also revealed the driver had a history of this substance abuse and the corporation knew about it before hiring the driver, but hired the driver anyway.

Then, the taxi cab company is sued in court and loses. The victims get almost nothing because the corporation had so few assets under its name. Instead, the assets are under the sole shareholder’s name. Since the corporation is its own legal entity, the corporation is liable, but the sole shareholder is not. Theoretically, the sole shareholder might get away with this sham, but a court might find a way to prevent this apparent injustice by piercing the corporate veil and allowing the plaintiffs to directly sue the sole shareholder. Factors considered by the courts in order to pierce the corporate veil include:

– Whether or not the corporation had adequate capitalization to normally conduct its usual course of business and meet future business obligations

– Whether the corporation and its shareholders observed corporate formalities

– Maintenance of separate financial books for the corporation

– Mixing of financial assets between shareholders and the corporation

– Treatment of the corporation as a separate and distinct entity from its shareholders

– Misrepresentation or illegality by the shareholders

– Failure to pay dividends

– Whether the corporation was deliberately used as a shield or cover for personal dealings or liability by the shareholders.

These are just a list of some of the factors courts consider in deciding if the corporate veil should be pierced. Like many other things in the law, how the courts will rule depends largely on the facts of the case. For more information about the concept of a corporation as its own legal entity, as well as how courts decide to pierce the corporate veil, please contact us.